Our business model

Hunting’s financial and operational resources enable us to leverage our core competencies in systems design and production, precision machining and quality print-part manufacturing. This allows us to add value for our stakeholders.

Our business model

Hunting’s financial and operational resources enable us to leverage our core competencies in systems design and production, precision machining and quality print-part manufacturing. This allows us to add value for our stakeholders.

We develop proprietary technology

The development of new technology and products is a key element of our business model and strategy. This intellectual property and know-how is introduced to our blue chip customers as the drive for more efficient and safer delivery of oil and gas continues as well as addressing the challenging environments that the geothermal and CCUS sectors operate in. In 2023, the Group held 538 patents and trademarks, covering 153 products.

We manufacture close to where our clients need us

Hunting has a global operating presence in strategic locations to ensure that we are close to where our customers are drilling and developing any resource type. Our established operating footprint ensures that we can support our customers in the oil and gas industry and can be leveraged to address global geothermal and CCUS projects. At 31 December 2023, we manufactured in 11 counties, from 27 operating sites and have 16 distribution centres.

We leverage our brand and reputation through strong quality assured products

The Hunting brand is supported by our strong reputation for quality assurance and health and safety. These credentials drive customer loyalty and form the basis of most industry tenders, which support our success in increasing our market share in key product lines and multiple end-markets. During 2023, the Group manufactured 23.0m parts (2022 – 16.6m) with an internal manufacturing reject rate of 0.20% (2022 – 0.13%). The reject rate for goods shipped was 0.0006% in the year (2022 – 0.0013%). These metrics demonstrate the impressive quality and reliability of our products. This performance strengthens Hunting’s standing in its end-markets.

We train our employees and keep them safe

Our health and safety protocols have been developed to keep our employees safe, with our safety performance measured using an industry-wide performance indicator, which is monitored closely. In 2023, the Group had 24 recordable incidents (2022 – 23) leading to a total recordable incident rate of 0.91 (2022 – 0.97) compared to the industry standard of 4.0.

We provide critical supply channels

Our products are often manufactured using critical raw materials, which enable them to perform in highly challenging environments. We work hard to provide competitive supply channels to lower project costs without compromising on quality. Hunting is an independent provider of premium and semi-premium connections and precision engineered accessories for all oil and gas resource types, providing cost agility for our customers. The Group has a number of strategic partnerships, including our joint venture partner Jindal SAW in India, which produces OCTG pipe and tubulars, to which Hunting’s premium connections are applied for the local Indian energy market. This venture meets local content requirements. The Group also has strategic supply chain partners to support the accelerating energy transition sector, including the ten-year alliance with Jiuli and the five-year agreement with CRA-Tubulars.

We target blue-chip customers and suppliers

Hunting is a trusted supplier to some of the world’s leading energy companies, including integrated energy companies, international services groups, independent oil and gas producers, as well as leading engineering companies who operate in the global aviation, commercial space, defence, medical and power generation sectors. We target clients and end-markets who value strongly assured products and services, and who demand high-performance technology and products. We have developed long-standing relationships with our customers through our market-leading reputation for health and safety, quality and reliability, differentiated technology, availability and delivery, and customer service and support.

We leverage our expertise in materials and engineering

Hunting’s workforce comprises highly skilled engineers and machinists who lead the development and manufacture of our high-performance technology and products. Our expertise in mechanical and materials engineering and metallurgy, ensures that our products will perform in high-pressure, high-temperature environments. We are able to leverage this expertise into energy transition markets as well as high-value non-oil and gas markets, such as aviation, commercial space, defence and medical for diversification opportunities.

We operate in a responsible and sustainable way

Hunting’s responsible and sustainable approach to its global operations includes the monitoring of waste and emissions to ensure we have a minimal impact on the environment. We have recycled for many years and, more recently, have started to monitor our carbon and climate impact, with initiatives being introduced to reduce this impact. In 2023, the Group announced new 2030 emissions reduction targets as part of the Board’s drive to improve our carbon reduction credentials and to assist in the preparation of a Net Zero transition plan.

Facilities

The Group has an established global network of operating sites and distribution centres located close to our customers and within the main global oil and gas producing regions.

Our operating sites are used for the manufacture, rental, trading and distribution of products. The manufacture of goods and the provision of related manufacturing services is, by far, the main source of income for the Group. A significant portion of our manufacturing occurs in high-end, specialist facilities utilising sophisticated machines.

In certain product lines, particularly Perforating Systems, Hunting holds inventory to support its customers’ requirements Our distribution centres are primarily used in the Hunting Titan and intervention tools business groups, where close proximity to drilling operations is important.

Our operating segments

Hunting reports its performance based on its key geographic operating regions. Hunting Titan is a large, separate division, which is reported as a stand-alone segment that operates in several geographic locations. A description of each segment is noted below.

Hunting Titan

Hunting Titan manufactures and distributes perforating products and accessories. The segment’s products include perforating gun systems, shaped charge technologies, and well completion instrumentation, OCTG and Advanced Manufacturing. The Hunting Titan operating segment focuses predominantly on the US and Canadian onshore drilling and completion markets, but also services international markets from its operating sites in the US. Hunting Titan has a network of distribution centres throughout the US and Canada from which the majority of the segment’s sales are derived. Hunting Titan also utilises the global manufacturing footprint of the wider Group to assist in meeting customer demand and the Electronics business unit, which is part of the North America operating segment, manufactures switches on behalf of Hunting Titan. Hunting Titan operates from four operating sites and 14 distribution centres, located in Canada, Mexico and the US.

North America

Hunting’s North America operating segment incorporates the US and Canada OCTG businesses, and the Dearborn and Electronics businesses which form the majority of the Group’s Advanced Manufacturing product lines. The segment generates a large proportion of the Group’s non-oil and gas sales, which includes the Advanced Manufacturing group and the Trenchless business unit that services the telecommunications sector, which is reported under the ‘Other Manufacturing’ product group. The segment supplies OCTG, premium connections, subsea equipment, intervention tools, electronics and complex deep hole drilling and precision machining services for the US and overseas markets. The North America segment has ten operating facilities and two distribution centres, mainly located in Texas and Louisiana.

Subsea

The Subsea Technologies operating segment was formed on 1 January 2023 and comprises three business units: (i) Stafford, which manufactures hydraulic valves and couplings; (ii) Spring, which manufactures titanium and steel stress joints; and (iii) Enpro which manufactures flow access modules and flow intervention systems.

These businesses occupy different parts of the offshore / subsea equipment supply chain, with customers ranging from tier one OEMs to exploration and production companies.

The segment operates from three facilities, two being located in the US and one in Scotland, UK.

Europe, Middle East and Africa (“EMEA”)

Hunting’s EMEA operating segment comprises businesses in the Netherlands, Norway, Saudi Arabia, UAE and UK. The segment provides OCTG (including threading, storage and accessories manufacturing) in the Netherlands, Saudi Arabia and the UK. In the UAE the Group operates an equipment assembly function for well testing and intervention products as well as a global sales office for all of the Group’s product lines and operates a service and distribution function in Norway. The Group’s operations in Saudi Arabia are through a 65% joint venture arrangement with Saja Energy.

Asia Pacific

Hunting’s Asia Pacific operating segment covers three operating facilities across China, Indonesia and Singapore and services customers predominantly in Africa, Asia Pacific, India and the Middle East. In Singapore, Hunting manufactures OCTG premium connections and accessories and well intervention equipment. The Group’s Indonesia facility also completes threading and accessories work. In China, the Group operates from a facility in Wuxi, which has OCTG threading and perforating gun manufacturing capabilities.

Oil country tubular goods (“OCTG”)

Operating basis: Manufacturing trading

Overview

OCTG are steel alloy products and comprise casing and tubing used in the construction and completion of the wellbore. Hunting’s OCTG product offering includes premium connections, accessories and tubing. The Group’s proprietary premium and semi-premium connection technologies include SEAL-LOCK™, WEDGE-LOCK™ and TEC-LOCK™, which address most oil and gas resource developments. Hunting’s connection technology is applied to many oil and gas wells and is also directly applicable to the energy transition sector, serving geothermal energy and carbon capture and storage projects.

Hunting is also licensed to apply a variety of third-party thread forms and generic API threads, which allows us to complete a wider spectrum of threading work for clients. We source OCTG products from a significant number of major global steel producers and have strong, long-term relationships in the US, Canada, Europe and Asia Pacific.

Differentiators

The Group provides an independent OCTG supply chain to clients, sourcing through either distributors or steel mills. Hunting is one of the largest independent providers of OCTG connection technology, including premium connections.

Global operating presence

Hunting’s OCTG and accessories manufacturing businesses extend across North America, EMEA and Asia Pacific, accessing many of the world’s oil and gas basins.

Perforating Systems

Operating basis: Manufacturing

Overview

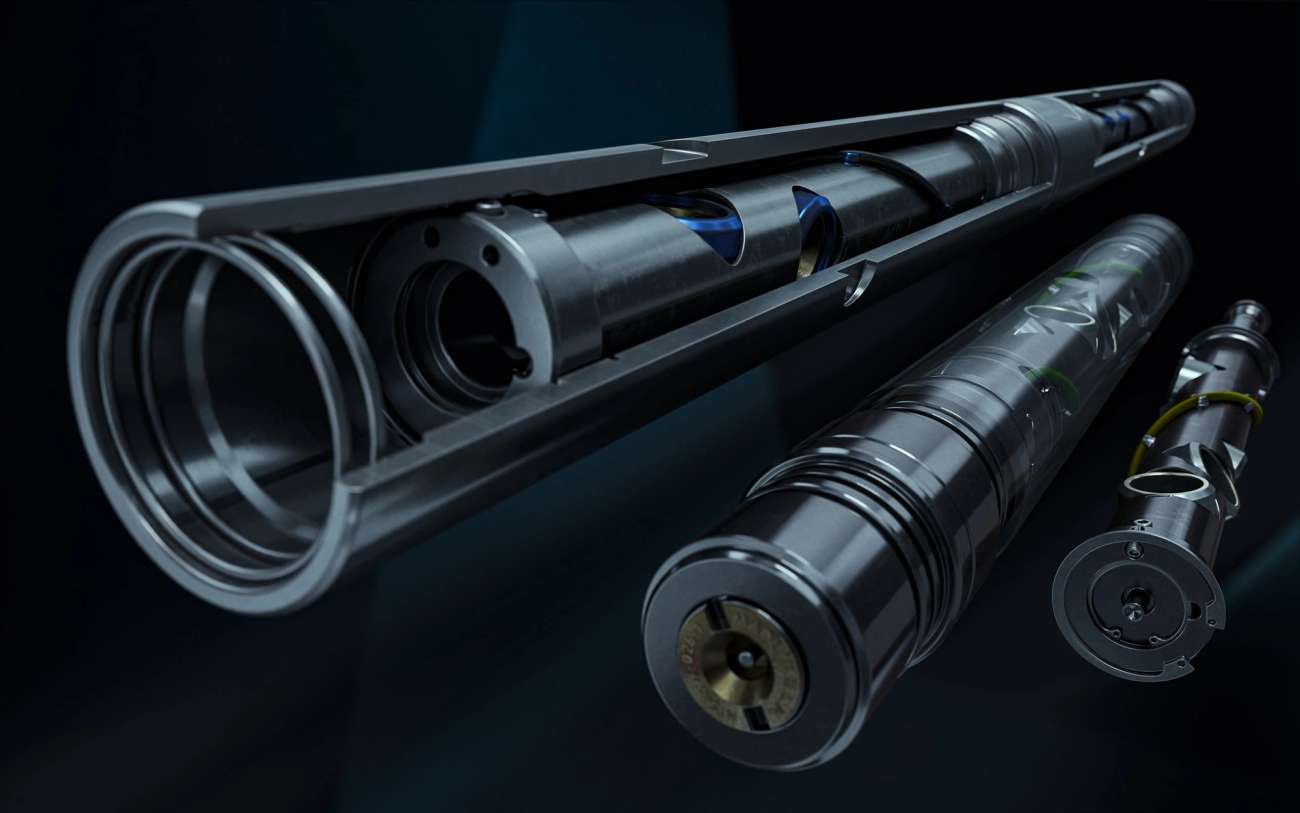

Hunting’s Perforating Systems product offering includes integrated gun systems, energetics and instruments. The Group’s H-2™, H-3™ and H-4™ perforating systems offer an integrated well completion solution to clients, which increases safety and efficiency. Hunting’s energetics products include the EQUAFrac™ suite of charges, which improve firing accuracy and efficiency. Complementing these products, Hunting’s instruments, including the Perf+ shooting panel, allow for in-field integration of systems and operations, which lowers the cost of development.

The production, storage and distribution of energetics is highly regulated and there are significant barriers for new entrants to the market. The business mainly “manufactures to stock” and hence uses a wide distribution network.

Differentiators

Hunting’s Perforating Systems technology platform and manufacturing and distribution presence across North America has maintained a market-leading position in this region for many years. The development of intellectual property has formed a cornerstone of the Group’s strategy to maintain this market position.

Global operating presence

Operating sites in North America and, Mexico and China. Distribution centres in North America and Asia Pacific.

Advanced Manufacturing

Operating basis: Manufacturing

Overview

Hunting’s Advanced Manufacturing product lines are utilised in both energy related and non-oil and gas applications such as aviation, commercial space, defence, medical and power generation markets. Hunting’s expertise is driven by its manufacturing know-how and precision engineering skills for high-value, critical applications as well as high temperature and pressure electronics applications.

Our electronics business manufactures high temperature/high pressure printed circuit boards used in downhole measurement tools as well as other sectors such as medical devices. Dearborn, our precision engineering business, manufactures MWD/LWD well tool housings, periscope tubes, aerospace engine shafts, and other products used in commercial space applications.

Differentiators

Hunting has unique manufacturing capabilities, which attract blue chip customers. These unique engineering capabilities will lead the Group’s expansion into non-oil and gas sectors. Hunting precision engineers mission critical products where failure is not an option. The Electronics business is a world leader in exotic alloy printed circuit boards processing and high temperature circuit manufacture. The Dearborn business is a world leader in the deep drilling of high grade, non-magnetic components. As a Group, Hunting has the ability to produce fully integrated advanced downhole tools and equipment, manufactured, assembled and tested to the customer’s specifications. Hunting has obtained key certifications in the medical and defence sectors, which create high barriers of entry for competitors.

Global operating presence

North America

Subsea

Operating basis: Manufacturing trading

Overview

Hunting’s Subsea product offering comprises three sub-groups: hydraulic couplings and valves used within subsea tree systems manufactured by the Stafford business unit; titanium stress joints manufactured by the Spring business unit, which are applied to floating production, storage and offloading facilities; and flow access modules and flow intervention systems used in modular offshore field developments manufactured by the Enpro business unit. A key theme of all these products is the safer and quicker delivery of oil and gas and, therefore, cash flow from offshore developments for our customers.

Differentiators

Hunting’s strong intellectual property and unique customer relationships across multiple subsea arenas provide defensible competitive advantage. Our expertise ranges from the manufacture of high pressure seals to complex welding of stress joints.

Global operating presence

North America and EMEA.

Other Manufacturing

Operating basis: Manufacturing equipment rental trading

Overview

Hunting’s Other Manufacturing product group includes the Group’s well intervention and well testing offerings, along with trenchless and organic oil recovery businesses. The well intervention business is serviced from the Group’s North America, Europe and Asia Pacific operations. The Group’s European well testing business is also incorporated into this product group, given its differing business model and profile to the other products groups. This business is more focused on European and Middle East markets. Hunting’s Trenchless business unit, which sells drill stems, connections and drill pipe into the global telecommunications industry is also part of the Other Manufacturing product group and forms part of the Group’s non-oil and gas sales. The organic oil recovery business is focused across EMEA, commercialising a licenced technology to optimise reservoir performance and recovery rates and extend the life of the well.

Differentiators

Hunting offers a comprehensive range of tools, including innovative and proprietary technologies.

Global operating presence

North America, EMEA and Asia Pacific.

Related principal risks

• Commodity prices

• Competition

Non-oil and gas

Operating basis: Manufacturing

Overview

Across the Group, efforts have been stepped up to diversify revenue streams and leverage our core competencies into new markets.The energy transition sector is an area of significant opportunity for Hunting, as global efforts to decarbonise the energy supply chain accelerate. The Group sees strong growth in supplying products for geothermal as well as carbon capture and storage projects, which are increasingly demanding high performance technology and materials that are capable of delivering multi-decade benefits to the energy industry.

Given the cyclicality of the oil and gas industry, a key part of our strategy is to build a less volatile revenue and profit profile. This will be delivered through organic and acquisitive growth of non-oil and gas businesses. We already sell into some of these markets, such as the aviation, commercial space, defence, medical, and power generation sectors, and will continue to leverage our world-class precision engineering and manufacturing know-how into these high-quality markets and industries.

Differentiators

Hunting’s complex, precision machining capabilities are applicable to many other sectors outside of oil and gas.

The Group has successfully positioned itself with a number of defence related businesses who recognise our expertise.

Global operating presence

North America, Asia Pacific.

Related principal risks

• Product quality

Our stakeholders

The Group’s stakeholders enable the delivery of Hunting’s business model and strategy.

Stakeholder engagement forms a key element of our culture and is an area which has increased over the past few years.

Understanding the needs of our shareholders, customers, suppliers and workforce is achieved by regular dialogue.

Shareholders & lenders

Our shareholders and lenders provide equity and loan capital to the Group. The Directors regularly engage with shareholders and lenders to discuss performance, strategy, governance and other matters. This feedback is used to refine our strategic plans.

Our employees

Hunting’s employees deliver our strategic plans and are the Group’s most important asset. We are committed to training and developing our workforce, and keeping them safe through the operation of stringent health and safety policies. The Board meets regularly with management and the workforce through site visits and engagement programmes.

Our customers

Our clients are critical to the financial success of the Group. Customer dialogue helps us shape our product development strategy and provides focus to our service offering. Hunting continuously works hard to deliver a secure supply chain for our clients and in the year signed new strategic agreements. A common theme across all of our businesses is our ability to add value for our customers, which is achieved by providing high-technology products that lower the cost of operation, resolve technical problems, or simply enable a job to be completed more quickly or safely, without compromising on quality.

Suppliers

Hunting’s supplier base facilitates the Group in achieving its purpose of providing highly trusted and innovative products for our customers. The Group ensures that critical materials are not sourced from a single supplier, which provides assurance to our customers that Hunting will always be in a position to deliver. Long lead-time material supplies are regularly reviewed to ensure market pricing remains competitive. Hunting’s management of its supply chain includes working with a wide range of suppliers with regular two-way dialogue on quality expectations. Hunting has signed strategic partnership agreements to further secure its supply chain, and to support the accelerating energy transition sector. A ten-year strategic alliance agreement was signed with Jiuli in 2023 to ensure the supply of OCTG casing to which Hunting’s SEAL-LOCK XDTM connection is applied. High-performance, corrosion resistant alloys (“CRA”) are now viewed as a critical material to deliver geothermal energy and carbon capture and storage projects. Hunting also signed a five-year collaboration agreement in 2023 with CRA-Tubulars to market its technology in the North America market. CRA-Tubulars manufactures titanium composite tubing, which is a corrosion resistant alternative tubular technology.

Environment & climate

The Group is committed to strong environmental stewardship. Our operating principals are focused on containing and reducing our carbon footprint, maximising recycling, reducing waste streams and increasing our climate change commitments.

Governments

The Group continues engagement with local regulators, tax authorities and governments throughout the year. Hunting continues to assist communities through a wide range of activities, including fund raising events and donations. Each region develops their own community initiatives to align with local cultural practices.

Our communities

The Group continues engagement with local regulators, tax authorities and governments throughout the year. Hunting continues to assist communities through a wide range of activities, including fund raising events and donations. Each region develops their own community initiatives to align with local cultural practices.

Sustainability accounting standards board (“SASB”) reporting

Throughout this section, Hunting has introduced the SASB reporting codes relevant to its non-financial data. Please refer to the SASB reporting tables on pages 226 and 227, which provide the detail to each area of reporting, Hunting’s compliance to the reporting recommendation and the page location of the relevant information.