Q3 2025 Trading Update

Hunting PLC (LSE: HTG), the global precision engineering group, today announces its Q3 2025 Trading Update.

Q3 Summary

· Group EBITDA of c.$100.5 million in the year to 30 September 2025 - up 15% year-on-year.

· Group EBITDA margin of c.13% recorded.

· c.$416.4 million sales order book at 30 September 2025.

· Hunting Titan is trading in line with expectations and well ahead of the same period in 2024 as improvements to financial performance are delivered.

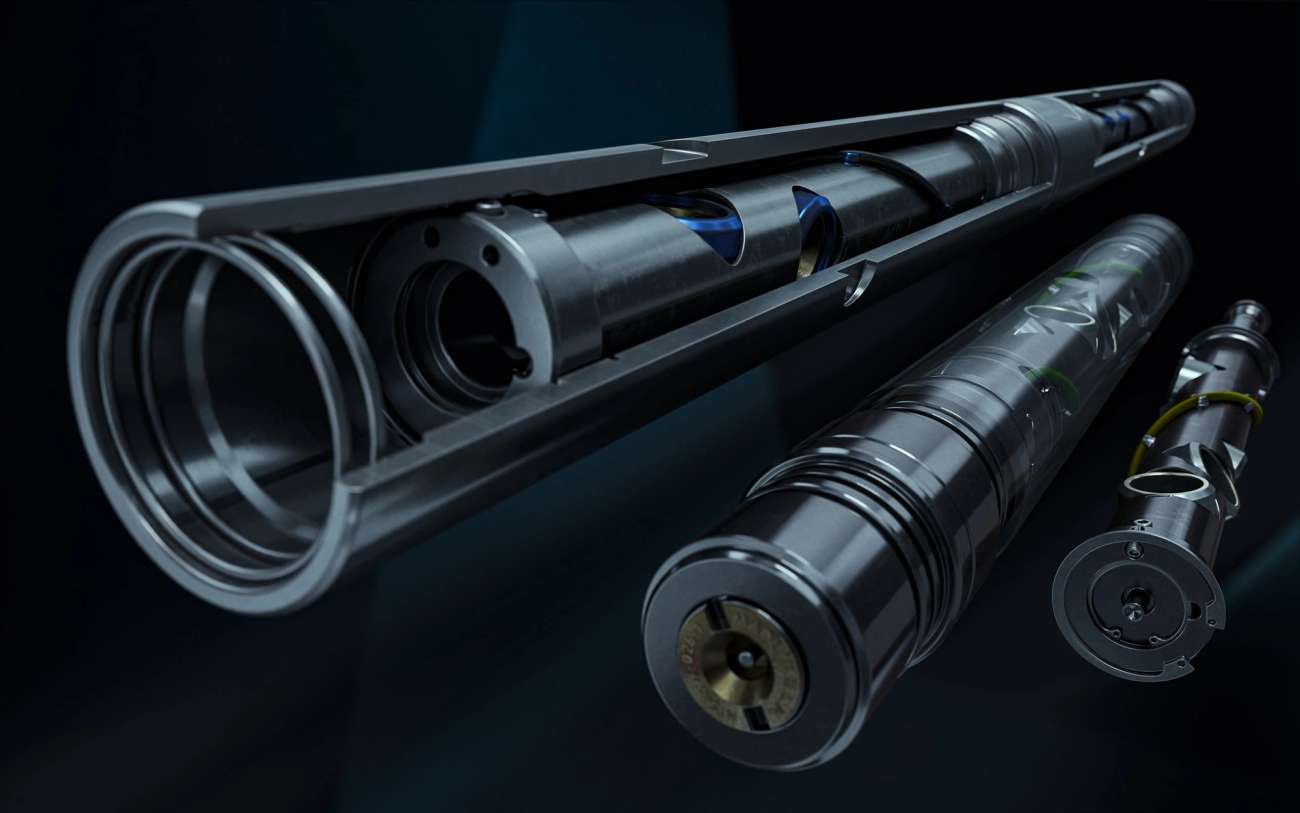

· North America operating segment performing marginally ahead of expectations, driven by robust demand for TEC-LOCK™ semi-premium connections.

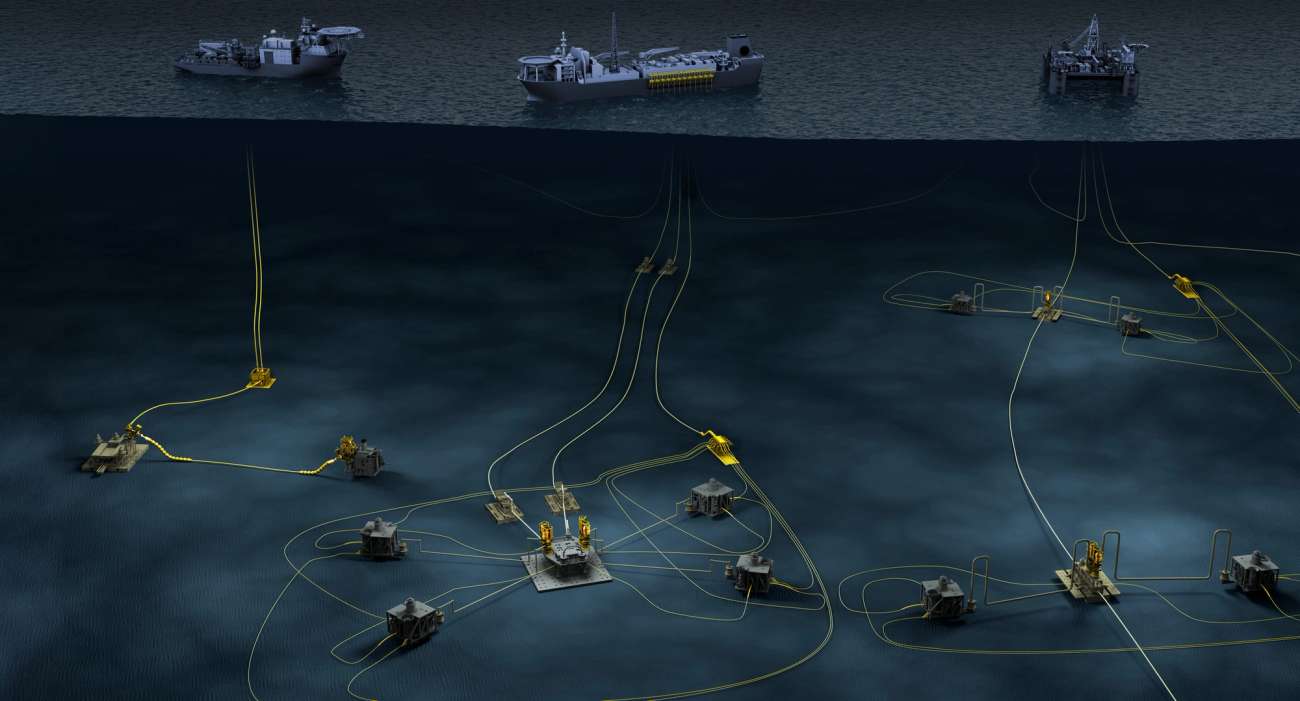

· Subsea reports trading in line with expectations in the year-to-date, with a robust market outlook to 2028. Integration of Flexible Engineered Solutions ("FES") progressing well, with cross selling opportunities being captured.

· EMEA restructuring continuing, with management on track to deliver annualised cost savings of c.$11 million by June 2026. The restructuring has disrupted trading to certain businesses within the region, leading to the Group's anticipated full year outturn noted below.

· Asia Pacific also trading in line with expectations.

· Organic Oil Recovery ("OOR") business scaling up following technology acquisition, with two treatments in the North Sea underway in the quarter for a major operator.

· Balance Sheet remains strong with net assets of c.$907 million.

Cash and Liquidity

· Total cash and bank / (borrowings) of c.$47.1 million at quarter-end, reflecting investment in inventory, and the impact of the share buyback.

· Total liquidity1 of c.$336.5 million as of 30 September 2025 available to the Group to pursue acquisition focused growth.

· The Directors continue to examine a range of bolt-on acquisition opportunities across all the Group's key product groups.

· During the period, the Group exercised its option to extend the maturity of the $200m RCF by 12 months to October 2029.

Outlook and 2025 Outturn

· 2025 EBITDA outturn is expected to be at the lower end of the Company's published guidance range of $135-$145 million, representing strong year-on-year growth compared to 2024.

· c.$30 million / 75% of share buyback to be completed by year-end.

· Year-end cash and bank / (borrowings) anticipated to be c.$40-$45 million, which includes projected cash to be absorbed from the share buyback, in addition to the impact of working capital instruments utilised by the Group.

Jim Johnson, Chief Executive of Hunting, commented:

"The encouraging performance at the half year has continued into the third quarter with Hunting delivering a 15% year-on-year increase in its year-to-date EBITDA thanks to trading within the OCTG product group.

"The integration of FES has continued in the quarter with strong cross selling opportunities being identified, above those anticipated at the time of acquisition.

"Our balance sheet remains strong, coupled with a robust year-end cash projection and Hunting retains c.$336.5 million of liquidity available to pursue growth opportunities, while also balancing these with increased shareholder returns. Management is also continuing to review high quality acquisition opportunities, with a focus on subsea and well completions."

Q3 Trading Update

Hunting's trading performance during Q3 2025 was, overall, in-line with management's expectations across most operating segments and product groups.

The Hunting Titan operating segment reports stronger profitability compared to the prior year, as management focus on improved production efficiencies, while also capitalising on market activity in South America and the Middle East. Trading within the North America operating segment has been marginally ahead of expectations, due to strong OCTG sales in the period, offsetting some softness within the Advanced Manufacturing product group. The Subsea Technologies operating segment delivered better results throughout the quarter as orders for ExxonMobil Guyana and TPAO in the Black Sea were progressed. Management now expects FES to contribute c.$3 million to the Group's EBITDA result for 2025. Multiple cross selling opportunities have been identified since acquisition, which are being developed by management, as the integration continues. The restructuring within the EMEA operating segment continues, with the facilities being closed in the Netherlands and Norway in the period, coupled with the opening of the Group's larger facility in Dubai, UAE. This led to some disruption to trading during the quarter. The Group's Asia Pacific operating segment has continued to trade in line with expectations.

Year-to-date EBITDA of c.$100.5 million reflects an in-line trading result across all the Group's product groups and operating segments. Group EBITDA margin of c.13% has been achieved in the year-to-date.

On 30 September 2025, total cash and bank / (borrowings) was c.$47.1 million.

Under the Company's share buyback programme, which began on 28 August 2025, 3,510,198 Ordinary shares have been purchased for cancellation, absorbing c.$15.6 million to 21 October 2025 before costs.

The Group's balance sheet remains strong, with net assets on 30 September 2025 of c.$907 million. Working capital is marginally higher since the Half Year at c.$366.5 million, reflecting raw materials purchases made in the quarter for committed orders. Management anticipates that working capital will reduce by c.$25 million by the year-end.

The 2025 interim dividend of 6.2 cents per share will be paid on Friday 31 October 2025, which will absorb c.$9.6 million.

Capital expenditure for the full year is now anticipated to be c.$35-$40 million, comprising tangible and intangible expenditure.

The Group continues to report a strong tender pipeline across most product groups. New, large tenders are being assessed by management for the Group's OCTG product group. Management has a positive outlook for Subsea orders, as new tenders are anticipated to be issued during 2026.

Management continues to evaluate several acquisition opportunities, with the focus remaining on subsea and well completion targets.

Outlook and 2025 Outturn

The Directors remain vigilant and continue to monitor the macro-environment closely for increased signs of volatility. Trading remains steady across most product groups, with the expected outturn for the year at the lower end of the Company's guidance range of $135-$145 million. Year-end cash and bank / (borrowings) is likely to be in the range of $40-$45 million, assuming that the share buyback continues at the current rate of market purchases.

Date of Next Trading Update

The Group's next Trading Update is scheduled for Tuesday 13 January 2026.

Notes:

1. Total liquidity is comprised of Hunting's $200 million revolving credit facility which remains undrawn; uncommitted facilities of $89.4 million and total cash and bank / borrowings of $47.1 million.

For further information please contact:

Hunting PLC

Jim Johnson, Chief Executive

Bruce Ferguson, Finance Director

Tel: +44 (0) 20 7321 0123

Sodali & Co

James White

Pete Lambie

Tilly Abraham

Tel: +44 (0) 77 4840 4399

or